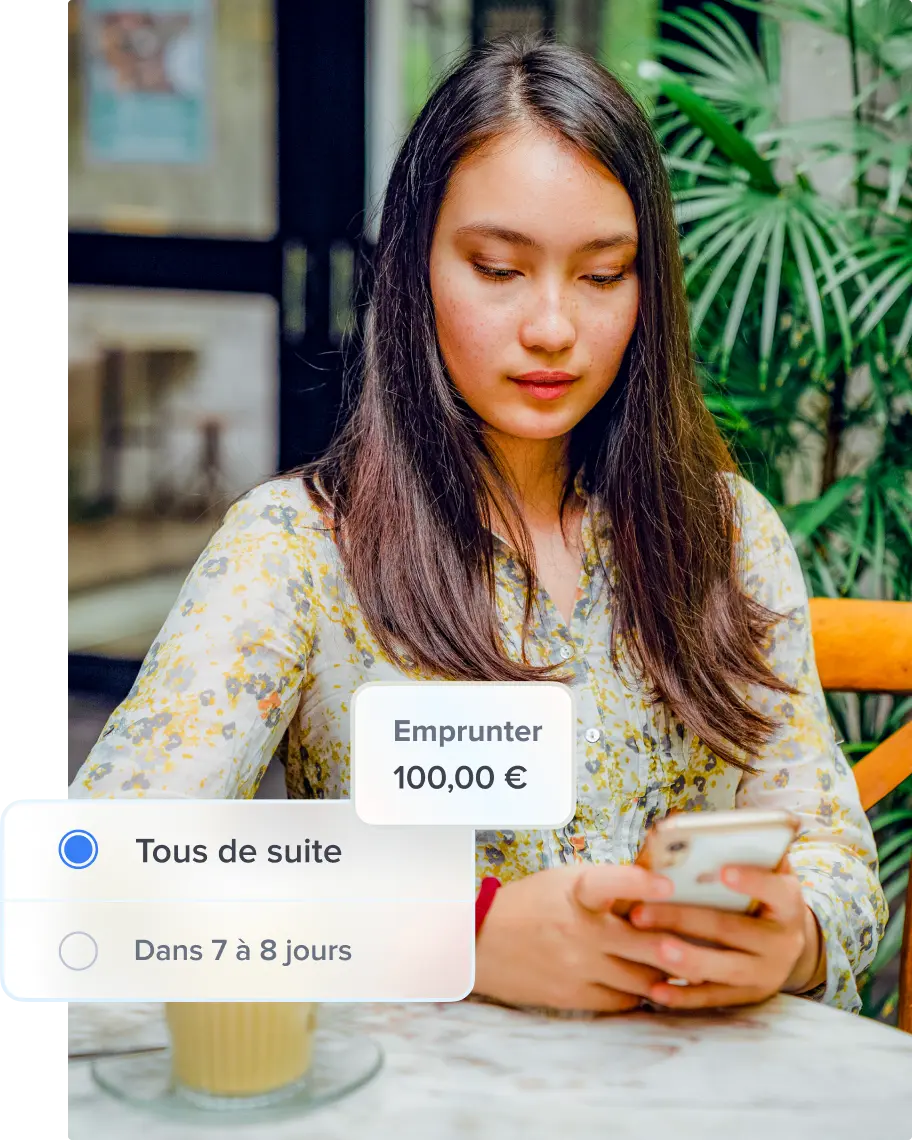

Express loans

Lydia gives you access to loans ranging from €100 to €1,500 right from your app and without any paperwork. You can receive the money right away with an instant deposit, and you can use it however you like.

A customized loan in a matter of minutes

With Lydia, enjoy a loan ranging from €100 to €1,500 paid into your Lydia account or your bank account.

Everything is done in-app: no paperwork. And the answer can be immediate.

An alternative to bank loans and overdrafts

Loan amount, loan term, monthly payment amount, interest rate… No nasty surprise or hidden fee.

All information relating to your loan application are clearly displayed in the loan calculator before the contract is signed.

After the loan request is validated , there are no unexpected expenses.

For all your projects

Shoes, a new smartphone, a bike… Finance anything you want with Lydia loans.

You don’t have to tell us what you want to buy: what you do with your money is none of our business.

Lydia manages the experience, they lend the money

FLOA Bank, for payment facilities

FLOA Bank is a public limited company registered with the Bordeaux Trade and Companies Register (RCS) 434 130 423, with a €42,773,400 capital, whose head office is located at Bâtiment G7, 71 Rue Lucien Faure, 33300 Bordeaux. FLOA Bank is a credit institution subject to the Autorité de Contrôle Prudentiel et de Résolution (bank code: 14628) and registered as an insurance or reinsurance broker and insurance agent with ORIAS under the number 07028160